When people earn a lot of money in any country, you need to contribute a portion of your earnings to the development of the country. It’s very proud for taxpayers to do this because you get benefits from the society where you work. Citizens are responsible for paying taxes in every country. In the Philippines, you can request a TIN (Tax Identification Number) ID that proves you are a taxpayer from your nearest BIR (Bureau of Internal Revenue) office. If you don’t know how to apply for a TIN ID, in this article, we will show you the complete guide, application requirements, fees and other steps to get your TIN ID.

What Is TIN ID?

A TIN ID (Taxpayer Identification Number Identification Card), also called a TIN card or TIN ID card, is a card issued by the BIR in the Philippines that contains the holder’s unique identification number, complete name, address, birth date, picture, and signature. It is not only a must-have card for registered taxpayers, but also a valid ID when you need to show your identity when transacting with government agencies, such as police clearance, SSS transactions, postal ID and so on. Surprisingly, the TIN ID doesn’t have an expiration date, so you don’t need to renew a new one like a passport or other ID card. Therefore, no matter which TIN cards you have, the yellow-orange one previously issued or the new green one, both are long-term TIN ID cards.

TIN ID Requirements 2024

Before you start applying for a TIN ID, you must prepare the following documents in advance.

- Tax identification number

- Completed BIR registration form by employment classification

- A valid ID, such as a birth certificate, passport, LTO driver’s license, or community tax certificate

- 1×1 picture (if applicable)

- Marriage contract (if applicable)

Here are some different application forms:

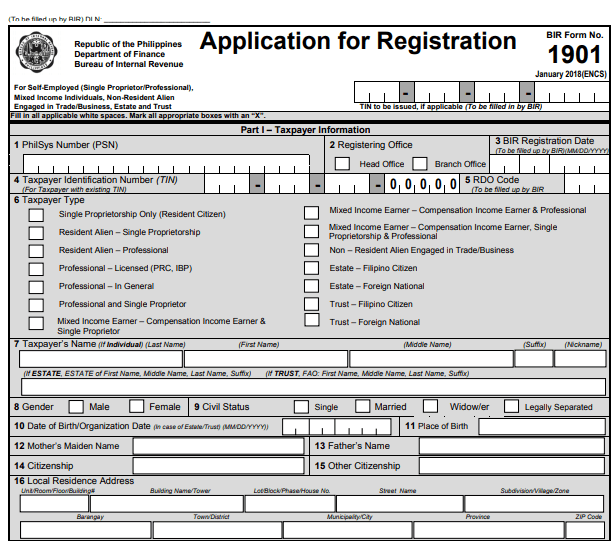

- BIR Form 1901 – For self-employed persons, mixed-income individuals, non-resident aliens engaged in trade/business, estates, and trusts.

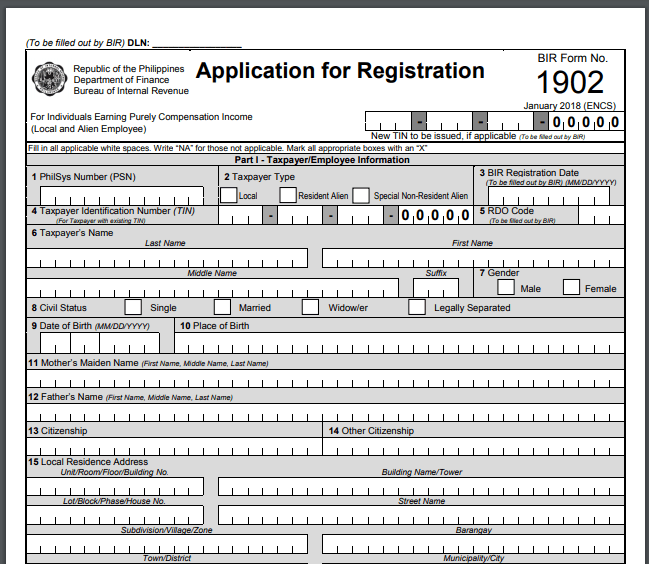

- BIR Form1902 – For persons earning income solely from compensation.

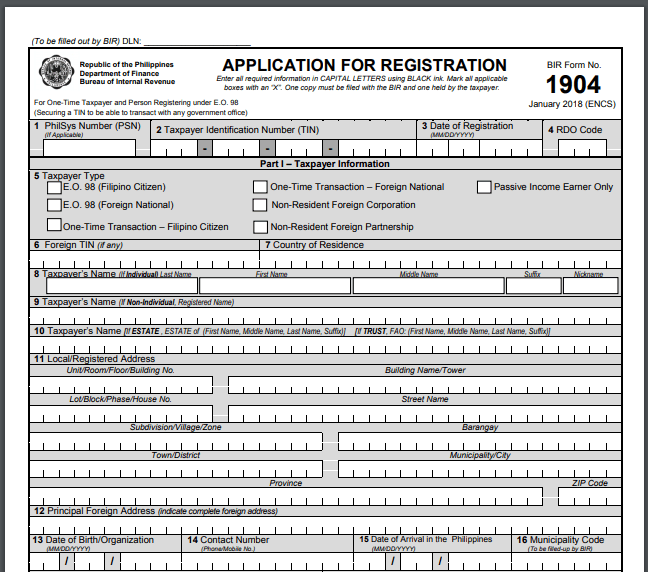

- BIR Form1904 – For one-time taxpayers and persons registered under Executive Order 98

How to Get TIN ID

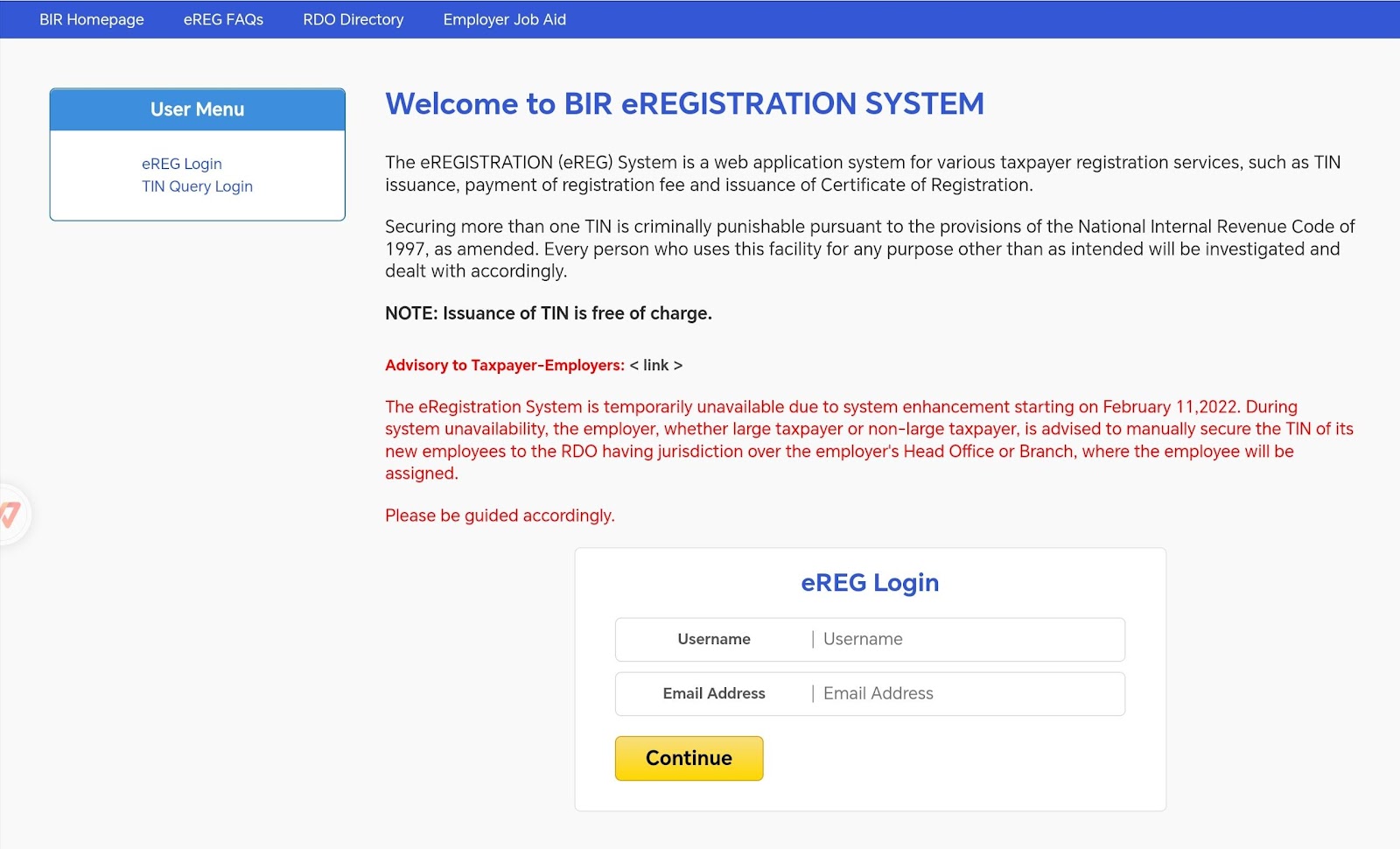

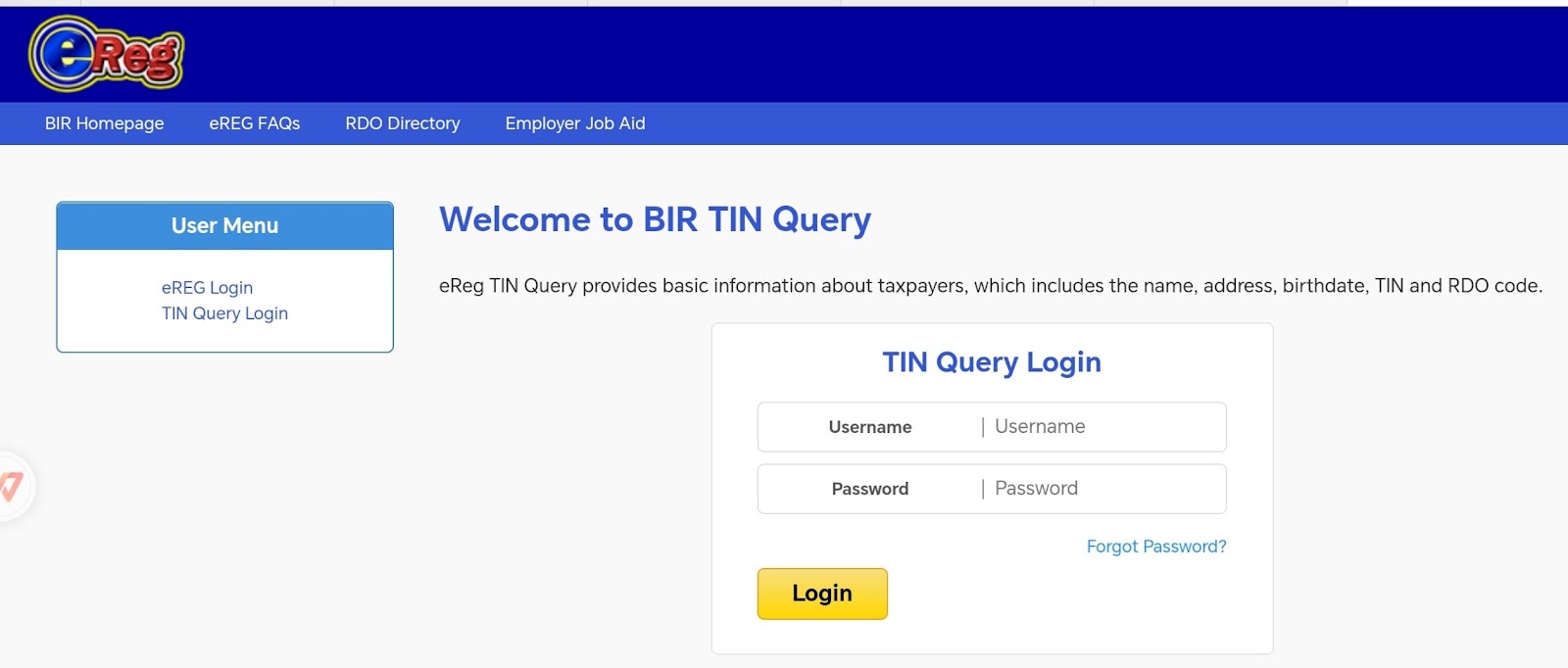

If you do not have a TIN, you can apply in person at the Bureau of Internal Revenue branch offices. In fact, if you don’t want to physically appear at the BOI branch, you can get it through eTIN, an online application system that issues TIN to taxpayers. It is more convenient for citizens to access the TIN application. But as you can see, the eREG platform is not available from 2022, so it’s suggested to have you TIN from the BOI branch directly.

How to Obtain A TIN ID if You Already Have a Tax Identification Number

According to the rules, taxpayers can’t get their TIN ID in any Revenue District Office (RDO) which has jurisdiction over the taxes in the taxpayer’s home or your employer’s office. It means that you can only obtain your TIN card at the designated RDO. If you already have a TIN, you can follow the steps below to get a TIN card easily.

- Obtain and complete BIR Application Document 1902 (for income-earning and non-resident citizens) from the RDO – Client Support Section Area tom or download it from BIR ‘s website.

- Go to the designated RDO and submit the required documents mentioned above.

- Wait for officials to verify that you are registered with the RDO and appear in person in the RDO. If yes, process the card application. Otherwise, taxpayers will be introduced to the registered RDO.

- You can obtain your TIN Card and paste the latest 1×1 TIN ID photo in front of the Registration Officer.

Usually, if you submit your application before the 1:00 p.m. deadline, the RDO will process your application and let you pick it up the same day. However, if you submit the application later than the deadline, you are requested to obtain it on another working day. Remember, you must apply and obtain the TIN Card yourself. No authorized representatives are allowed to obtain the TIN card from the RDO.

How Do I Apply for a TIN Card if I Am Not Employed?

If you are a student or unemployed individual over the age of 18, you can still obtain a TIN ID under Executive Order No. 98. Here’s how to get a TIN ID:

- Finish BIR Form 1904

- Prepare the required documents: Birth certificate, driver’s license, passport, or any other document issued by an authorized government.

- Bring and submit the files to the RDO of the city you’re living in.

- Once your application is completed, you can wait for the issuance date of your TIN ID.

- When you get your TIN card, attach your 1×1 ID picture to it.

How Much Is TIN ID?

TIN ID issuance is free of charge. But you need to pay ₱100 for the damaged or replaced TIN card. If you apply for a business TIN as a professional or mixed-income earner, you need to pay ₱500 for the registration and ₱30 for the documentary stamp tax or DST.

How Do I Know if I Have a Previous TIN?

Every Filipino has a TIN in their life. If you keep two, you’re breaking the law. So you can find out if you have one or not. Let eTIN, the BIR database, help you search for results. If not, you can apply for a new one on the eTIN.

What Should I Do if I Lose My TIN ID?

If you accidentally lose your TIN ID, you can pay ₱100 for a replacement. Follow the steps below to get a new one.

- Complete BIR Form 1905 (Registration Information Update Form)

- Obtain Form BIR 0605 (Receipt to pay the replacement fee).

- Prepare the notarized affidavit of loss old TIN card and other required documents.

- Take them to your designated RDO, and get a new TIN ID.

Conclusion

In this article, we have shown you how to get your TIN ID card. Yes, the TIN ID is a must-have for taxpayers. Don’t get this from some advertising channels. It is free for every taxpayer to apply.