UTR number is of great importance in various tax-related transactions, such as filing tax returns, registering self-employment, requesting tax refunds, or contacting tax departments. Learning about this tax reference is an important part of performing tax obligations. In this passage, we are going to explore what is a UTR number, who needs to apply for one, how to get it, and some frequently asked questions.

What is a UTR Number

UTR number, referring to a Unique Taxpayer Reference, is a tax identification number in the UK. The number is issued by Her Majesty’s Revenue and Customs (HMRC) at the time of registering for a self-assessment tax return or establishing a limited company. It is used to identify a taxpayer’s account and link payments to the bills. It remains unchanged after issuing throughout your whole life.

The code consists of 10 digits and some end with the letter “K”. Let’s see its format.

- First 2 digits – representing the issuing authority, a specific HM Revenue and Customs (HMRC) office.

- Next 6 digits – representing the owner of the UTR and distinguish different taxpayers in the same tax office.

- Final 2 digits – validating and ensuring the accuracy of the code by detecting errors and discrepancies.

Who Needs a UTR Number

The NTR number is needed when HMRC tracks your tax obligations and refunds overpaid tax, when you file self-assessment tax returns or calculate company tax, and when you partner with accountants.

Individual and business entities in the UK that are obliged to file a tax or have tax-related matters with HRMC need the tax reference, such as:

- Self-employed persons

Freelancers, contractors, individual business persons, consultants, or others who work for themselves should get a UTR if your income needs reporting.

- Limited companies

A UTR is required for limited companies (either private or public) and UK branches of foreign companies.

- Partnership

Businesses formed by more than one person or entity should get a UTR and each partners under the partnership also need an individual UTR.

- Investors

Those who earn money by investing in shares, cryptocurrency, or property and have tax obligations must have a UTR, so as trusts (whether discretionary or non-discretionary) and estates.

- Landlords

Those who earn from selling or renting properties and are required to file tax should acquire a UTR.

- People who are employed but have a side hustle

- Non-profit organizations

Charities and NGOs that do not run for profits need a UTR to request annual tax returns.

How to Get a UTR Number Online

There are multiple channels for first-time applicants to get a UTR and online registration is known as the quickest one. Here is step-by-step guidance depending on whether you are registering as an individual or entity.

For Self Employed or Sole Trader

You must register with HMRC for self-assessment supposing that your total income in the previous fiscal year (between April 6th to April 5th of the next year) before tax relief reached 1,000 GBP or higher. The UTR number will be automatically released upon self-assessment registration. Please note that it cannot be used as company UTR. Here are instructions on how to register.

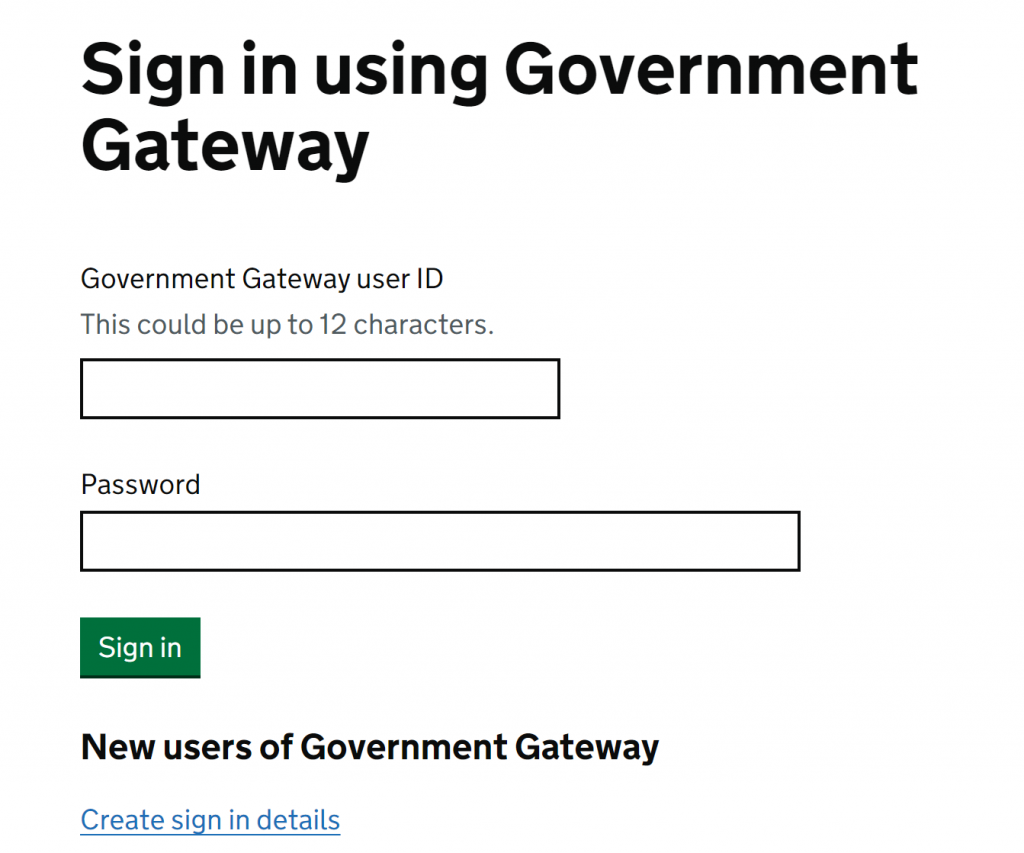

- Log in to your Business Tax Account within HMRC with your user ID and password. If you haven’t registered, create an account.

- Provide required personal and business information, such as name, date of birth, address, email address, phone number, the nature of business, and the date when the self-employment began.

- Wait for the HMRC to post the code.

For Partner or Partnership

You must register your company with the Companies House, after which the Company House will inform the HMRC about the incorporation of the business. The HNRC will send a letter containing your company’s UTR code to the registered office address. To apply for UTR number online for free, you should log in to your Business Tax Account and provide the following details.

- The company’s registration number.

- The company registered name.

- Business type.

After your request is submitted, a copy of the company’s UTR will be sent to the business address you provided to the Companies House.

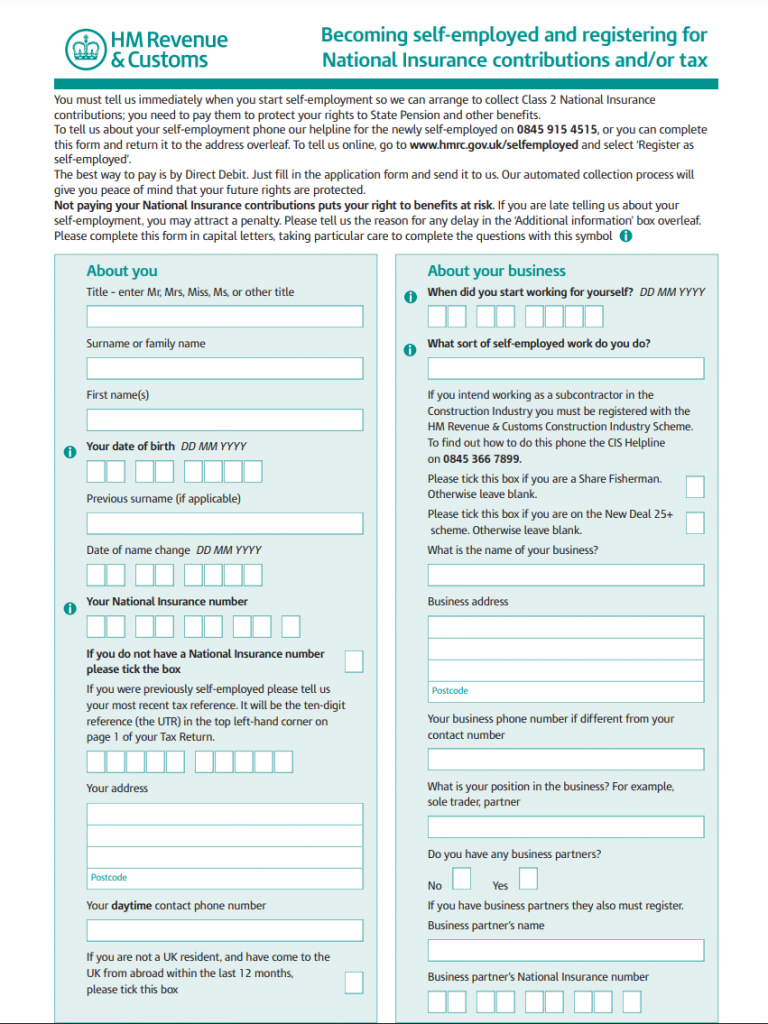

How to Get a UTR Number by Post

HMRC also accepts inquiries by mail. In this case, you are supposed to:

- Fill out the CWF1 form online with National Insurance number, date of birth, gender, name, home address, phone number, etc.

- Print out the form and send it to HMRC office at:

Self Assessment

HM Revenue and Customs

BX9 1AS

United Kingdom.

- Receive the UTR code by mail.

How to Get a UTR Number by Phone

HMRC self-assessment helpline is available during 8:00 am and 6:00 pm from Monday to Friday except bank holidays. There are different departments for different issues. For self-assessment, please call 0300 200 3310 inside the UK, or 0300 200 3319 outside the UK. The advisor will ask for information about you and your business to verify your identity, after which the Unique Tax Reference Number will be delivered to you by mail in a few days.

However, the helpline might be busy and takes up to 1 hour to get through. The best time to call is between 8:30 am to 9:30 am or between noon and 12:30 pm on Thursday, Friday, and weekends. Don’t call at peak hours, like 4:30 pm to 5:30 pm, otherwise, you might wait for more than usual or even be cut off.

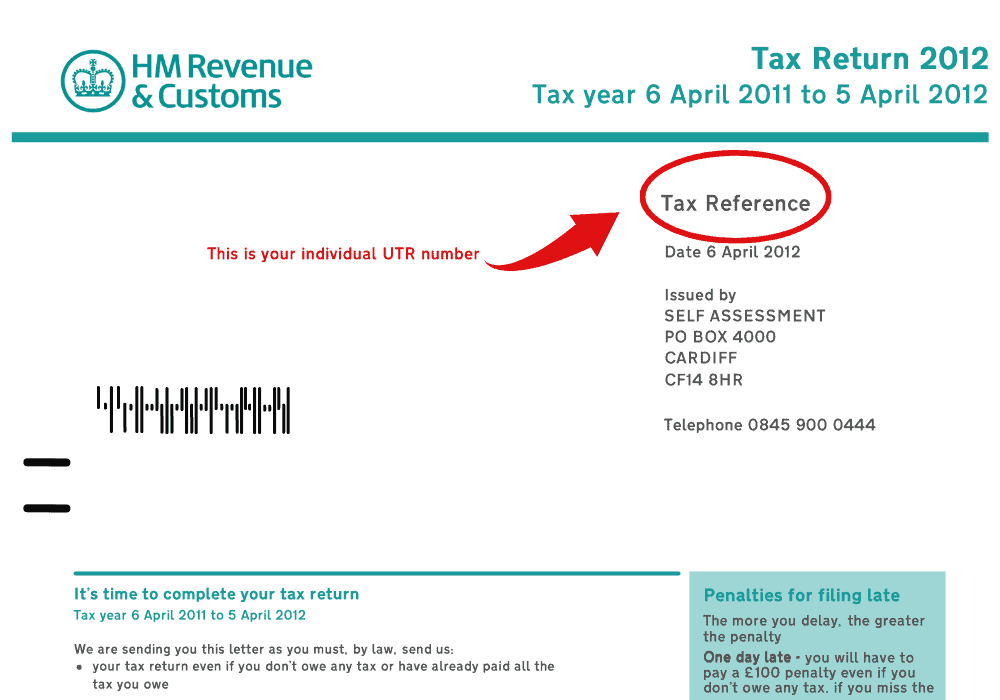

Where Will I Find my UTR Number

The 10-digit code is available in the HMRC mobile app, the HMRC website, and any correspondence from HMRC, such as:

- SA250, the letter from HMRC about 10 days after self-tax assessment registration.

- Your personal account statement

- Previous tax returns

- Reminders of tax returns from HMRC

- Reminders of payment from HMRC

How to Find a Lost UTR Number

The number is unique for every taxpayer. Losing it might lead to information leakage or even identity theft. Many people might wonder how to find my UTR number when it is lost. Don’t be nervous. Check the documents we stated before and see whether you can find them. If not, you can retrieve it through one of the following methods.

- Online

It can be found in the Self-assessment Section or at the top right corner of your account summary after signing in to your HMRC online account.

- On HMRC App

Download the app from GOV.UK according to your mobile phone’s operating system and it can be used to check not only UTR for self-assessment but also tax code, National Insurance number, employment and income history, state pension, etc.

- By Phone

If you have no access to online services, you can contact the Self Assessment helpline at 0300 200 3310 and it will be sent to you by post, but it might take up to 7 days. The operator might ask for your personal information as well as your National Insurance number to verify your identity.

How Long Does it Take to Get UTR Number

The processing time is subject to how to get a UTR number. Online application is considered the fastest way while mail and phone applications need extra time to receive extra information from HMRC. Generally speaking, it takes about 7-10 days to receive the activation code after all required information is gathered when applying from within the UK and about 21 days when applying from abroad.

FAQ

Q: How to check if my UTR number is valid?

A: The unique taxt reference number will never expire, but it might be marked as dormant If you haven’t submitted a Self Assessment for a long time. If you are not sure about the status, you can contact HMRC at 0300 200 3310 to check.

Q: Is UTR number and transaction ID the same?

A: No. The transaction ID is a unique code for each specific transaction aiming to secure financial transactions while UTR is used to identify the taxpayer’s identity.

Q: Can you share your UTR number?

A: No. It is confidential information. Never share it when you are not sure what it will be used for.

Q: Can I submit a tax return online without a UTR number?

A: No. The number is an identifier for each taxpayer’s account. Paying taxes online will prevent HMRC from matching your your payment to your account.

Q: How much does it cost to get a UTR number?

A: It’s completely free of charge.

Summary

After reading this passage, the answer to “What is a UTR number?” is quite straightforward. It is a unique tax reference number for self-assessment tax returns. It is automatically issued after self-assessment registration. When it comes to how to get a UTR number, you can obtain it online, by phone, or by post. If you forget or lose the code, it can be checked out in correspondence from HMRC letters, HMRC online account, HMRC app, or HMRC helpline.