Are you disturbed by the high tax in Australia? Are you looking forward to lodging taxes electronically because it’s too troublesome to visit a physical Australian taxation office? Are you confused about filing taxes in Australia as a foreign employee or resident? Are you looking for ways to apply for an Australian Business Number (ABN) as a business?

If all these answers are yes, it is time to apply for TFN. In this passage, we are going talk about what TFN is, its benefits, requirements, application methods, and some frequently asked questions.

What is TFN?

TFN refers to Tax File Number, usually in 9 digits. Issued by the Australian Taxation Office (ATO), it is a unique reference number for individuals to file taxes or check taxation information in the Australian tax and superannuation systems. The number remains unchanged forever once issued even if the owner changes name, employer, address, or other personal information.

How To Find My TFN

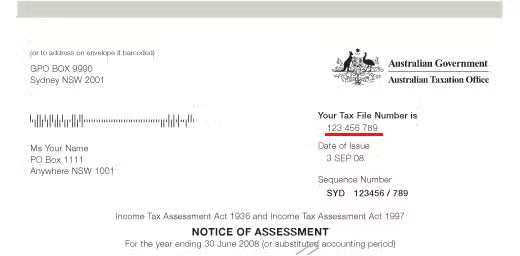

If you forget your TFN number, it can be found:

- In the ATO app or ATO online account;

- On your income tax notice of assessment;

- In the letters sent from ATO;

- On a payslip or income statement from your employer;

- On your superannuation account statement;

- From a registered tax agent (if any).

Importance of Applying for TFN

Although it is not mandatory to have a tax file number, you might be required to provide your tax file number (TFN) on the condition that you are:

- Creating an account at a bank or financial institution.

- Starting a new job.

- Requesting government benefits.

- Lodging a tax return.

- Applying for loans for higher education.

Moreover, you can enjoy more benefits with it. For example:

- Your employer or financial institution will withhold less tax from your income or interests.

- You can request government benefits or allowances, such as job seeking allowance.

- You can lodge your tax return online.

- You can apply for an Australian business number (ABN) as a business.

Requirements for TFN Application

You are eligible to apply for TFN at any age if you are one of the following:

- Australian citizens with an Australian passport.

- Australian residents.

- Foreign passport holders, permanent migrant visa holders, work visa holders, student visa holders and other temporary visitors living in Australia.

- People living outside Australia whose income is from an Australian source (interest, dividends or royalty payments not included), whose income comes from Australian business interests, whose spouse is residing in Australia and requesting family tax benefit or child care subsidy, who is a member of Australian superannuation, or who needs to apply for an Australian business number (ABN).

- Norfolk Island residents.

- Aboriginal and Torres Strait Islander people.

How to Apply for TFN in Australia

TFN can be obtained online, at Australia Post, or service centers, depending on whether you are an Australian citizen living domestically, abroad or non-Australians. It is free of charge to apply for TFN. However, if you apply by post, you should pay the postage.

Required Documents for TFN Application

- TFN application form for individuals living in Australia. You will use an online form when applying at Australia Post. You can also order a paper form when applying at a Services Australia center or by post.

- TFN application form (for individuals living outside Australia)

- Identity Documents which consist of primary documents and Secondary documents. Applicants aged at least 16 should offer 3 documents while those below 16 should provide 2 documents. In both cases, one of them must be a primary document.

- Primary documents

- Australian full birth certificate (not Extracts or Commemorative Certificates)

- Australian passport

- Australian certificate of citizenship or Extract from Register of Citizenship by Descent

- Foreign passport

- Secondary documents

- Medicare card

- Bank statement within the last year from an Australian bank, credit union or building society or ATM card.

- Australian firearm licence. The signature and photo must be consistent with that on your online form

- Student photo ID card issued by Australian government-certified educational institutions

- Australian driver’s licence

- Australian learner’s permit

- Proof of age card issued by State or territory government

- Photo card issued by the State or territory government

For applicants under 16, the following are also acceptable when they are issued by Australian government-accredited education authorities within the last year.

- Secondary school examination certificate

- Record of achievement

- Examination report

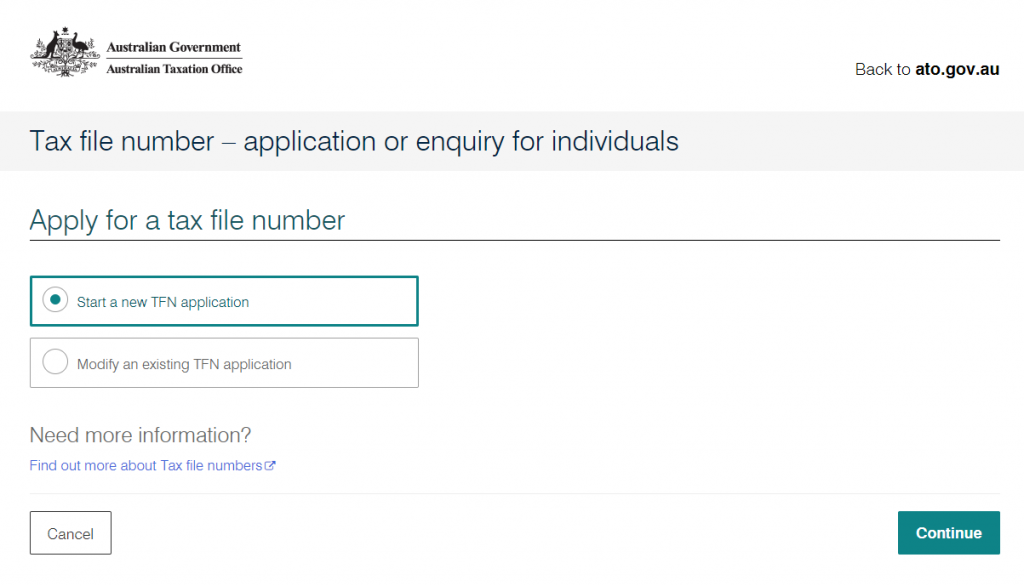

Apply for TFN Online

Online applications are only available to those aged at least 15 years old, with an Australian passport, and at least one other Australian identity document. The passport can be valid or expired for up to 3 years. Let’s see how to apply.

Step 1. Set up Strong myGovID

First of all, download the myGovID app on your mobile device which is available on Apple AppStore or Google Play Store. Then, create an account by providing personal details, such as full name, date of birth, and email address. If you already have it, just log in.

Secondly, verify your Australian passport and another Australian identity document, such as your birth certificate, citizenship certificate, provisional or full driving licence, or medical card.

Last but not least, verify your photo through face scanning, which aims to compare your real-time picture with that on your passport.

Step 2. Review the Terms and conditions

You have to agree

- To receive your TFN on the screen

- Not to receive your TFN by post

- To download or print your TFN number

- To link your myGov account to ATO online member services

- On the terms and conditions and privacy notices.

- Apply for TFN

Select “Apply online for your TFN”, prove your identity for ATO and complete your TFN application. Make sure to use the same email address for your myGov account and your Digital Identity.

The TFN will be generated straight away on the screen, so you can download or print a summary for storage. The whole process takes about 20 minutes. If there is a reference number instead of a tax file number on the screen, it means the authority needs to further review your application, which takes another 28 days. The reference number can be used to check the progress.

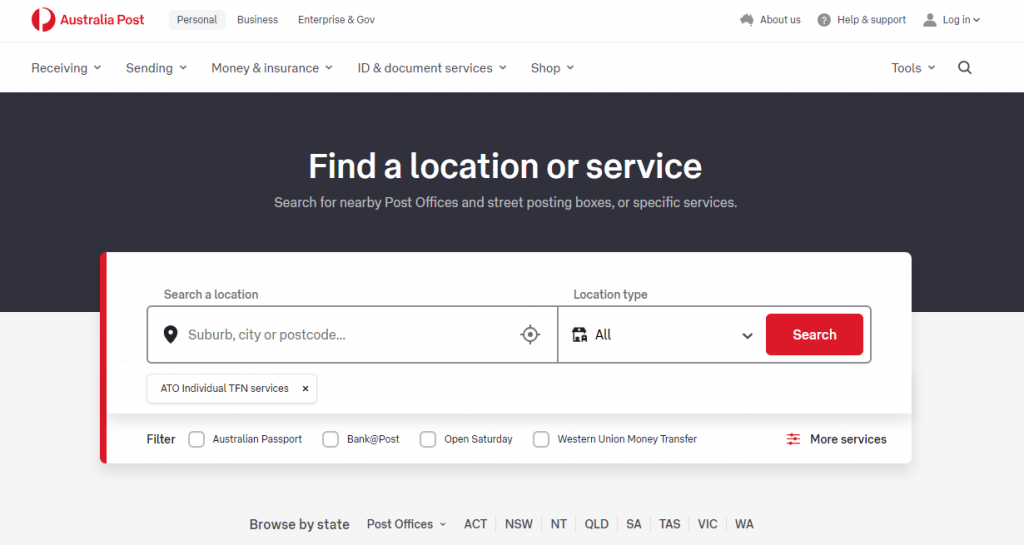

Apply for TFN at Australia Post

It applies to all Australian citizens and residents as long as they can attend an interview. To apply at a participating Australia Post retail outlet, please do as follows.

- Fill in the online TFN application form. Don’t use the IE browser.

- Print the application summary in which there is a reference number.

- Schedule an appointment for a face-to-face interview at a participating Australia Post outlet, which should be made within 30 days after finishing the form.

- Attend your interview with the printed application summary and original copy of identity documents.

- Sign your application at Australia Post. Your TFN will be issued in 28 days.

Apply for TFN at Services Australia Centre

Services Australia customers can apply in person at a Services Australia service centre through the steps below.

- Download and complete a paper TFN application form.

- Go to the nearest service center with the form and identity documents listed on the form.

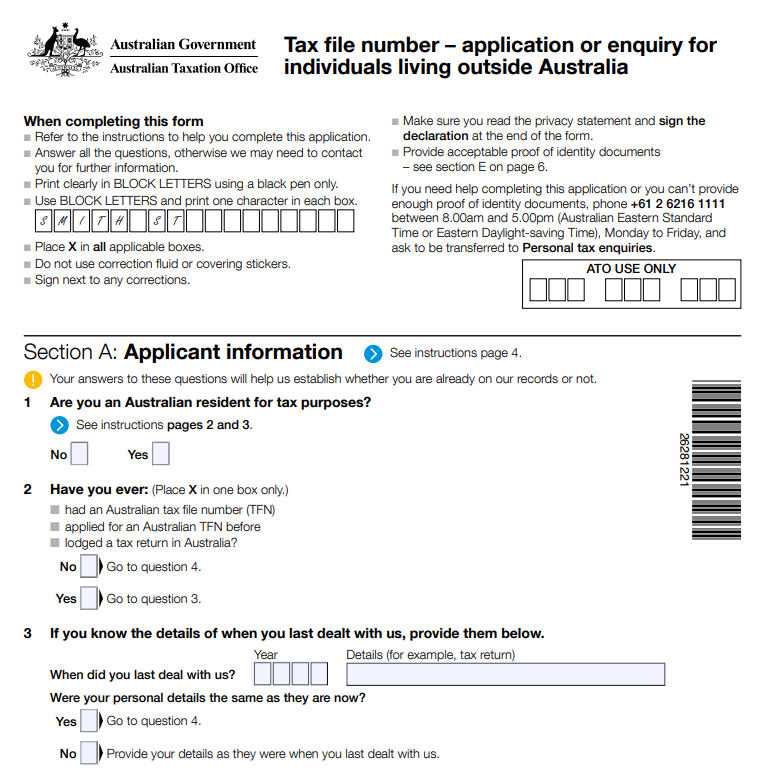

Apply for TFN by Post

It is suitable for foreign residents for tax purposes or those with no access to online or in-person applications. While applying in Australia, download the TFN application form. While applying outside Australia, finish Application or Enquiry for Individuals Living Outside Australia. mail the completed form to the address on it along with photocopies of your proof of identity documents. Don’t send an original copy because it might not be returned. No matter where you apply from, wait for 28 days to receive your tax file number.

How to Update TFN Registration Details

Whenever there is a change in your TFN registration details, including your contact information, name, date of birth, gender and financial institution details. How to update it depends on what you change.

Update Contact Details

- ATO online services. Or,

- Call ATO. Speak to speak to a customer service representative. Please call during business hours from 8:00 am to 5:00 pm from Monday to Friday. Or,

- Download the Change of details for individuals Form and post it to the address on the form after completing it.

Update Name and Tile

- Online. Sign in with myGov and go to “Linked service > Australian Taxation Office > My profile > Personal details > Name”. Or,

- Call ATO. Or,

- Complete the Change of details for individuals Form and mail it to the address on the form along with copies of original supporting documents.

You must present proof of name change, such as:

- Full birth certificate

- Marriage certificate

- Certificate of name change

- National photo ID card

- Passport

- Driving licence (with the same address on ATO systems).

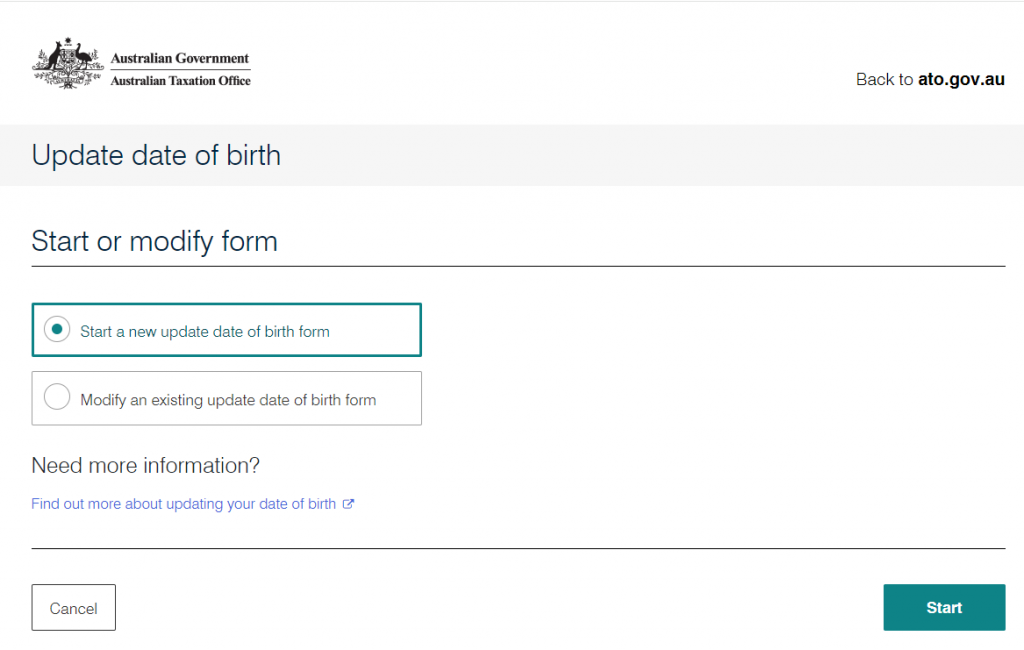

Update Date of Birth Record

- Online. Sign in with myGov and go to “Linked service > Australian Taxation Office > My profile > Personal details > Update date of birth”. Or,

- Visit a nearby Australia Post with a printed summary of completing an online form and supporting identity documents. An appointment is needed before visiting there. Or,

- Call ATO. Or,

- Complete the Update Date of Birth Form and mail it to the address on the form along with copies of original supporting documents.

Supporting identity documents are listed as follows.

- Australian full birth certificate

- Australian passport

- Australian citizenship certificate

- Foreign birth certificate

- Foreign passport

- Australian driver’s licence

Update Gender

- Call 13 28 61 between 8:00 am–6:00 pm from Monday to Friday (in Australia) or +61 2 6216 1111 between 8:00 am–5:00 pm AEST and ask to transfer you to “Personal tax enquiries” (outside Australia). This method is only available when your gender information is recorded incorrectly. Or,

- Write a letter when you have changed your gender. The letter should clearly state your name and address provided before, new name and title (if applicable), request to update gender, and signature. Post the letter and supporting documents to the address below.

📍 Australian Taxation Office

PO Box 3373

ALBURY NSW 2640

AUSTRALIA

Acceptable documents for gender change include:

- A valid Australian passport or other government-issued travel document indicating your preferred gender (sex)

- A birth certificate with your preferred gender (sex)

- A document from a state or territory Registrar of Births, Deaths and Marriages that certifies a change of gender (sex)

- A statement from a Registered Medical Practitioner or Registered Psychologist which specifies your preferred gender (sex), which also includes the practitioner or psychologist’s letterhead, their name and contact information, their declaration on verifying their treatment on your or evaluation of your history, your name and your chosen gender, their signature and their registration number from the Medical Board of Australia or Psychology Board of Australia or an equivalent overseas authority.

Update Financial Institution Details

- Online. Sign in with myGov and go to “Linked service > Australian Taxation Office > My profile > Financial institution details”. Or,

- Call ATO.

FAQs

Q: Do all Australian citizens apply for TFN?

A: No. It is not mandatory, but it is suggested to obtain one for tax purposes.

Q: Can non-Australians apply for TFN?

A: Yes, as long as you are filing taxes in Australia.

Q: How to secure my TFN?

A: Don’t disclose it to uncertified people or organizations. It is safe to provide TFN to the Australian Taxation Office, your employer, bank or financial institution, government agencies, college or superannuation fund.

Q: What if my TFN has been lost, stolen or used by a third party without authorization?

A: Tell ATO Client identity support center as soon as possible by calling 1800 467 033 between 8:00 am and 6:00 pm from Monday to Friday. The staff there would re-establish your identity and guide you to prevent identity theft or misuse.

Summary

After reading this passage, you must have learned that you can benefit a lot from obtaining a Tax File Number (TFN). As TFN is free of charge and applies to a wide variety of taxpayers either in or outside Australia, it is suggested to apply for one. As long as you can provide approved identity documents, the TFN application is quite simple, which can be done online, at Australia Post, at Services Australia Centre or by post. It takes a few minutes or 28 days to receive the number depending on the way you apply. Finally, don’t forget to update it if you change your personal information.