In Canada, there are a variety of public welfare systems aiming to provide financial support to seniors. The requirements and benefits vary from plan to plan. Canada Old Age Security (OAS) Pension is a good example. In most cases, Canadians aged 65 and above will be automatically enrolled in the program when the authority has sufficient information. However, if you haven’t received an enrollment from Service Canada after you turned 64, you should apply for old age security. In this passage, we are going to introduce old age security application and some frequently asked questions.

What is Old Age Security Card

Canada Old age security card, also known as OAS card, is a proof of age issued to Canadian citizens aged at least 65 years old under the old age security program. The program is a taxable monthly pension scheme, an essential part of Canada’s public retirement income system. Based on this program, the beneficiaries can add other income sources to solve financial difficulties. For example, low-income OAS pensioners will also receive a Guaranteed Income Supplement (GIS). GIS beneficiaries’ low-income spouses or common-law partners who are aged 60 – 64 or widowed can receive allowances.

Old Age Security Eligibility

Whether you are qualified for OAS payment depends on your age, residence, and citizenship, as described in the following conditions.

OAS Eligibility for Individuals Living in Canada

- be 65 years old or above.

- own Canadian citizenship or legally reside in Canada at the time of approval.

- have lived in Canada for no less than 10 years since 18 years old.

OAS Eligibility for Individuals Living Outside Canada

- be 65 years old or above.

- have been a Canadian citizen or a legal resident in Canada before leaving the country.

- have lived in Canada for no less than 20 years since 18 years old.

OAS Eligibility for Individuals Working for Canadian Employers Abroad

The time you work abroad can be counted as the duration of residence in Canada. To be eligible for OAS, you must:

- return to Canada within six months after the employment ends, or

- have been 65 years old and filing taxes for employment and residence in Canada while working abroad.

When to Apply for OAS Card

In Canada, eligible citizens will be granted an automatic registration and Service Canada will mail a notification letter to you within a month when you reach 64. For example, if you were born on March 31st, 1960, you will receive a written notice in April 2024.

However, there are times when the automatic enrollment fails because some essential information is missing. Supposing that you don’t receive the notice after 1 month past your 64th birthday, you should contact Service Canada to make sure whether you need to file an old age security application. Moreover, the application is also required when Service Canada sends you a letter to ask you to apply or when there is wrong information in the written notification.

How to Apply for Old Age Security Card

After confirming that you need to submit an application for old age security in Canada, you can start the process online or by mail.

Prepare Required Documents

No matter which way you choose to apply for OAS, the following documents are necessary to prove your identity, residence, etc.

- Proof of legal status

It could be such as a certificate of Canadian citizenship, naturalization certificate, Canadian passport, record of landing, permanent resident card, or temporary resident permit. It is not required when you were born in Canada and have lived in the country for your entire life.

📢Read Also: Everything You Need to Know about Applying for Canada Passport

- Proof of marital status

If you are married, submit a marriage certificate. For common-law relationships, complete a Statutory Declaration of Common-aw Union (ISP3004).

- Proof of birth (optional).

- Confirmation of residence periods in Canada (optional).

🔎Read Also: What is Confirmation of Permanent Residence (COPR)

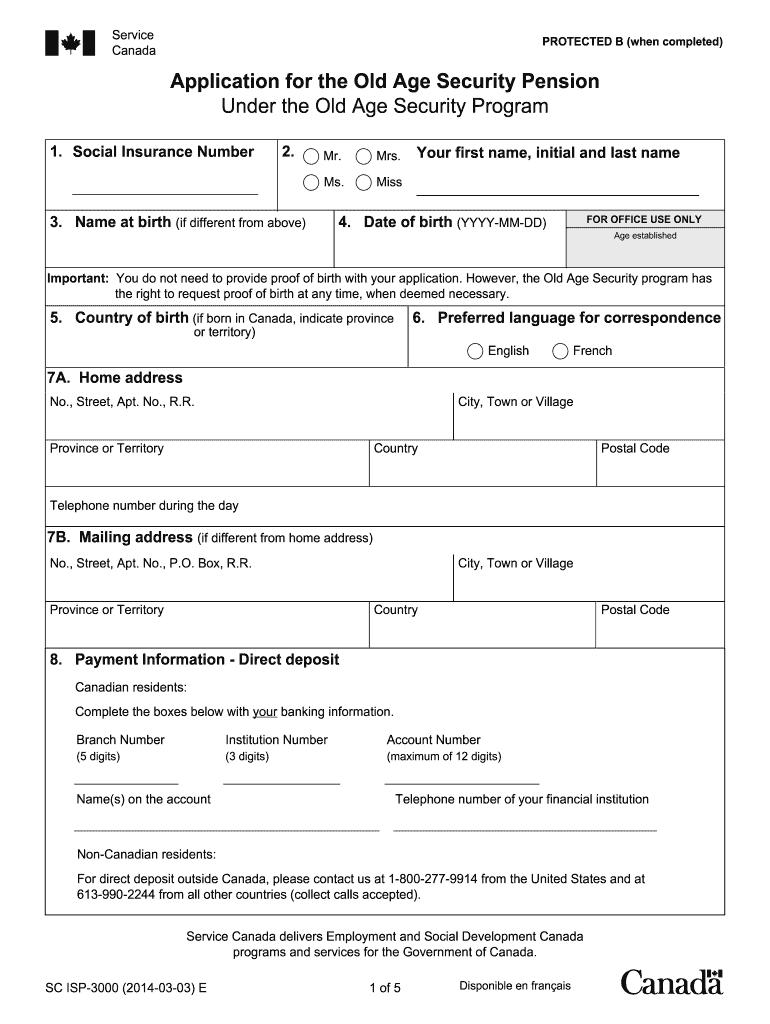

Old Age Security Application Online

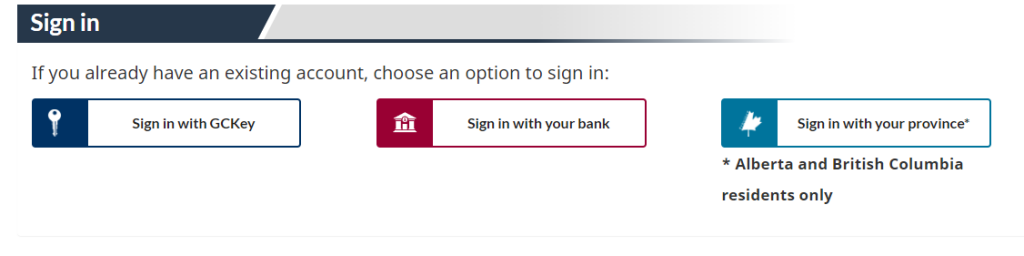

- Create a My Service Canada Account (MSCA).

You can register with GCKey, an online banking account, or a provincial digital ID.

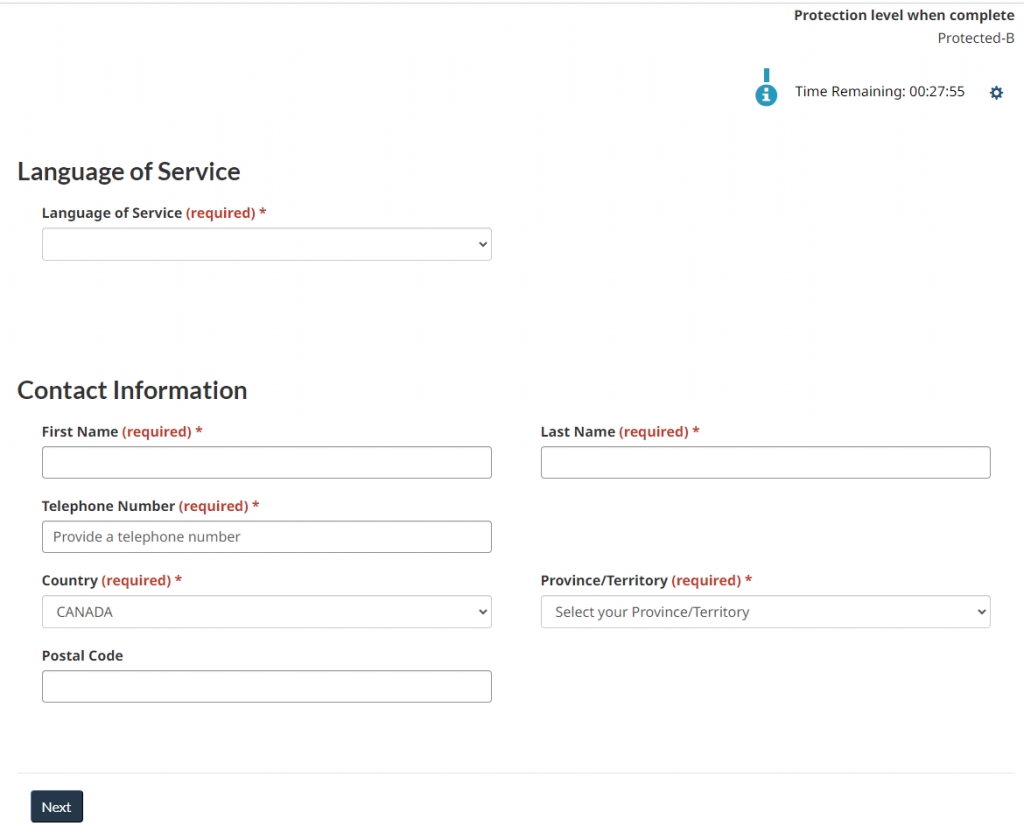

- Fill out the Application Form Online

You have to provide personal information, legal status, residence history, guaranteed income supplement, and payment method. It is suggested to gather the necessary information in advance of yourself and your spouse or common-law partner (if you have one), such as Social Insurance Number (SIN), banking information, date of birth, address, contact, etc. Online the online application starts, you cannot save it and continue later.

- Wait for the Application Results

You will receive a letter indicating whether your application is approved/rejected or requires extra proof. If you gain approval, the letter will include how much you can receive each month, the date of the first payment, and previously owed payments.

Old Age Security Application by Mail

- Fill out the Old Age Security Application Form and print it out.

- Include certified copies of the required documents.

- Send the completed application form along with the supporting documents to the nearest Service Canada office listed below.

| Service Canada office | address |

| NEWFOUNDLAND AND LABRADOR Service Canada | PO Box 9430Station ASt.John’s NLA1A 2Y5 CANADA |

| ONTARIO Service Canada (for postal codes starting with “L”, “M” or “N”) | PO Box 5100 Station DScarborough ON M1R 5C8 CANADA |

| ONTARIO Service Canada (for postal codes starting with “K” or “P”) | PO Box 2013 Station Main Timmins ON P4N 8C8 CANADA |

| PRINCE EDWARD ISLAND Service Canada | PO Box 8000 Station Central Charlottetown PEC1A 8K1 CANADA |

| NOVA SCOTIA Service Canada | PO Box 1687 Station Central Halifax NS B3J 3J4 CANADA |

| MANITOBA AND SASKATCHEWAN Service Canada | PO Box 818 Station Main Winnipeg MB R3C 2N4 CANADA |

| NEW BRUNSWICK Service Canada | PO Box 250 Fredericton NB E3B 4Z6 CANADA |

| ALBERTA/ NORTHWEST TERRITORIESAND NUNAVUTService Canada | PO Box 2710 Station Main Edmonton AB T5J 2G4 CANADA |

| BRITISH COLUMBIA AND YUKON Service Canada | PO Box 1177 Station CSC Victoria BC V8W 2V2 CANADA |

| QUEBECService Canada | PO Box 1816 Station Terminus Quebec QC G1K 7L5CANADA |

OAS Payment Rates 2024

Supposing that you have lived in Canada for 40 years or longer after 18 years old, you are eligible to get a full OAS pension, otherwise, you will only receive partial pensions. Here is a table for the maximum old age security payment. Please note that the table does not apply to partial OAS pension.

| Situations | Annual Net Income | Maximum monthly payment amount |

| Recipients aged 65-74 | less than $134,626 | up to $713.34 |

| Recipients aged 75 and older | less than $137,331 | up to $784.67 |

Except for the old age security pension, the OAS scheme also provides three benefits, including Guaranteed Income Supplement (GIS), Allowance, and Allowance for the Survivor. Here is a list of the maximum payment for old age security supplement.

| Pension Benefits | Situations | Annual Net Income | Maximum monthly payment amount |

| Guaranteed Income Supplement (GIS) | Recipients who are single, widowed, or divorced | less than $21,624 | up to $1,065.47 |

| Recipients who have a spouse or common-law partner receiving a full OAS pension | less than $28,560(joint income of couples) | up to $641.35 | |

| Recipients who have a spouse or common-law partner receiving the Allowance | less than $39,984(joint income of couples) | up to $641.35 | |

| Recipients who have a spouse or common-law partner without OAS pension or Allowance | less than $51,840(joint income of couples) | up to $1,065.47 | |

| Allowance | Recipients who have or common-law partner receiving the GIS and the full OAS pension | Less than $39,984 (joint income of couples) | up to $1,354.69 |

| Allowance for the Survivor | a surviving spouse or common-law partner | less than $29,112 | up to $1,614.89 |

How do you Calculate OAS in Canada?

The Canadian government launched an online Benefits Estimator, allowing users to calculate how much they can receive based on the OAS scheme. Let’s see how the old age security calculator works.

- Choose when you were born and the system will calculate your age.

- Enter your annual income. Add all types of income after deducting pensions, benefits, annuities, salaries, and retirement fund withdrawals.

- Enter salary from work or self-employment income.

- Choose whether you have legal status in Canada. Please note that when you choose NO, you will be unable to proceed.

- Provide your residence history.

- Provide your marital status.

- Click on the “Estimate my benefits” button and you will see the final results.

FAQ

Q: Can I get OAS outside Canada?

A: Yes, as long as you have legal status in Canada and satisfy the old age security eligibility.

Q: Do all Canadians get CPP and OAS?

A: No. They are available to senior citizens. CPP is designed for individuals aged at least 60 years old and OAS for 65 years old.

Q: How many years do you have to work in Canada to get a pension?

A: At least 10 years.

Q: How much is old age security in Canada?

A: It is free of charge to apply for OAS.

Summary

Individuals aged at least 65 years old will be automatically registered with Canada old age security program. However, if you do not receive automatic enrollment notice, you should apply for old age security. After all required documents and information are prepared, you can submit an OAS application online or by post. Once your request is approved, you will receive full or partial OAS payment depending on your age, net income, legal status, residence history, marital status, and information about your spouse or common-law partner. Use the old age security calculator to calculate how much you can receive if necessary.